CrAdLE – Technology Business Incubator, supported by Entrepreneurship Development of India (EDII) which is a NODAL Institute under the Govt. of Gujarat startup schemes for Innovators/Entrepreneurs.

Scheme for Assistance to Startup/Innovation by Govt. of Gujarat

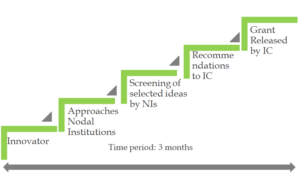

Startups in an economy’s technology sectors is an important indicator of technological performance for several reasons: first, the formation of new firms that focus on the development and introduction of new technology is a major source of innovation and technological advance. Many of these Startups transfer new knowledge or new ideas into products and processes into commercial applications. Startups are likely to bring in new solutions and challenge established by individuals/ companies that enter these new markets. To support startup moment Govt. of Gujarat has introduced Scheme for Assistance to Startup.

Scheme Eligibility

Any individual/group of individuals having innovative idea/Concept will be eligible.

Assistance for Innovation

- 10,000/- per month will be provided to the innovator as sustenance allowance for one year whose project is recommended and approved by institution’s Screening Committee.

- Up to Rs. 5 Lakhs assistance will be provided to the institution for mentoring service annually.

- Up to Rs. 10.00 Lakhs assistance will be provided for Cost of Raw Material/Components & other related equipment required for the innovative process for the new product development based on approval of the Screening Committee.

- Institution will support to the innovator by providing mentor services.

- Institution will allow the innovator to use facilities available in the institution for startups.

- will support selected innovator to get free access to University/Libraries/Govt. Laboratories/SDCs(GIDC)/CoE/PSUs to have more clarity on his innovative ideas/concept.

Assistance once the Idea/Concept get commercialized

- Marketing/publicity assistance of up to Rs. 10.00 lakhs will be provided for the introduction of innovated product in the market.

- Project of Innovated Product will be assisted in getting Venture Capital.

VAT Related Incentive

- The eligible unit shall pay the net VAT payable under the provisions of the Gujarat VAT Act, 2003 in the Government treasury.

- The eligible unit will be allowed reimbursement to the extent of 80% of the net VAT paid excluding the following: (a) Additional Tax, and (b) Reduction of ITC as per the provisions of the G VAT Act, 2003.It is clarified that the amount paid on account of additional tax and the reduction of ITC as per the provisions of the G VAT Act, 2003 shall not be reimbursed.

- Only 70% of eligible fixed capital investment of eligible unit will be considered for reimbursement.

- The reimbursement will be available for a period of five years from the date of production or the completion of limit of 70% whichever is earlier.

- The eligible unit shall be entitled for reimbursement up to 1/5th of eligible limit in a particular year.

- Restrictions will he made to ensure that the amount reimbursed is not again claimed by the subsequent dealers by way of tax credit for interstate sales, branch transfer, consignment and export.

- The eligible unit shall manufacture the goods in its own unit for which it is eligible for incentives.

- The eligible unit shall not transfer its business during the incentive period, nor assign its rights and responsibilities to any other agency.

- The eligible unit shall remain in production during the incentive period.

- The scheme shall be reviewed under the GST regime, but the total of assistance shall not exceed that available under this scheme.